You’ll probably find that net 30 invoicing is the most common, but some industries even have net 60 or 90 days. For example, if you perform a service for a client on July 1, and the invoice states “Net 30,” the client is expected to pay in full on or before July 30. Collections are the difference between making a living and working on a hobby.

Metro public bus service to slash Hobart services amid crippling driver shortage, union says – ABC News

Metro public bus service to slash Hobart services amid crippling driver shortage, union says.

Posted: Tue, 22 Aug 2023 04:48:33 GMT [source]

However, the convenience of fast cash comes at cost that can erode your profit. Many industries are taking advantage of technology to offer better, speedier B2B payments and credit. According to PYMNTS, the current Net Terms Economy exists mainly because of the cumbersome process of risk assessment for B2B businesses, coupled with the long waiting times to get paid. It’s crucial to negotiate your payment terms with your customer before you begin work. Once you come to a consensus, outline your terms in your contract.

Streamline your accounts receivable (AR) today by setting net terms

Learn more about the benefits of small business membership in the U.S. Review the background of Brex Treasury or its investment professionals on FINRA’s BrokerCheck website. Please visit the Deposit Sweep Program Disclosure Statement for important legal disclosures. Businesses may also seek funding from other sources because of the need to provide collateral or complete a lengthy application process.

Delinquent payments from customers and slow periods can drastically reduce a company’s cash flow. As a result, they can lack the funds required to purchase the inventory and supplies they need. To deal with this reality, most business owners offering net payment terms also charge interest fees on late payments.

Some may even offer Net 45 terms while others typically Net 90.

For example, if you have a regularly on-time paying customer, you might offer them a Net 60 term instead of a Net 30. In this comprehensive guide, we explore everything your business needs to know about net terms (also known as credit terms). We deep dive into digital net terms platforms, explore the advantages and disadvantages of net payment terms, and explain how to launch an effective payment terms program. While strong invoicing practices can help reduce the gap between completing work or delivering goods and getting paid, it can be complicated and time-consuming. Unfortunately, it may also not be enough to solve your cash flow issues. It’s also worth noting that having a late-payment penalty does not necessarily mean you have to assess one.

Some companies may count the date that an invoice is postmarked (day of mail delivery) or sent (email) or even when the goods and services are delivered. Net terms These details are usually made available to the customer beforehand. Typically, everyone agrees on the invoice terms when the sales agreements are made.

- B2C businesses often call this a financing, installment, or payment plan.

- HLC Bike prides themselves on leveraging net terms to incentivize healthy cash flow management amongst independent bike dealers, even when the dealers struggle to make their payments.

- Payments are normally made in cash, money order, or other agreed upon payment method.

- The easiest way to know what someone means is to think about what could naturally be deducted from something.

Under these arrangements, clients get services today and are given a grace period (e.g., 30 days) before they’re expected to settle their accounts. This flexibility gives clients enough time to repay their vendors by the time payment is due. As a way to drive sales while extending a helping hand, suppliers often offer net terms. If you order products with net terms for payment, you can take some time to pay the invoice. While this helps the supplier sell more products and helps the client overcome cash flow challenges, it can result in cash flow challenges for the supplier.

How Bigjigs Toys Uses Dropship to Test More Products With Retailers

Net terms can also help you build stronger client relationships over time. Net terms are often helpful to B2B companies that are also trying to manage and smooth their cash flow. When you make your clients’ lives easy, they’re more likely to continue doing business with you—and may even recommend your business to other customers. Realistic net terms — like 30 or 60 days — allow businesses to receive their payments at an expected time every month. Other net terms — like discount terms — give clients an excellent incentive for on-time payment. For example, discount terms may appear as 2/10 Net 30, which means that the final amount is reduced by 2% if the client pays the invoice in full within the first 10 days of the invoice date.

Credit cards may have a different repayment period, depending on the product.Find out how they work, and why you should care. This is why many companies wish to automate and de-risk their net terms program. While some of these are optional, depending on your industry (such as COD or CIA), others are standard, such as Net 30. If the client doesn’t have sufficient funds, it could lose the trust of the seller, who could then eliminate the net 30 terms completely. Before we dive into what the full implications of these terms are, including their advantages and disadvantages, let’s quickly look at what they mean. In this post, learn how tactics like upsells, bundles, post-purchase offers and more can boost your average order value.

Advantages of offering net 30/60/90 terms or credit terms

Now, the opportunity for a new, better Net Terms Economy that provides quicker payments has arrived. Both sellers and buyers can benefit from more timely credit decisions and on-demand funds. Software like QuickBooks enables customers to pay online anytime with pay-enabled smart invoices. With smart invoices, customers can pay using credit cards, debit cards, and automated clearing house (ACH) bank transfers. Immediate payment refers to a transaction for which payment is due as soon as you deliver goods or services.

Tottenham look further along than Man United, Barca’s Montjuic debut – ESPN – ESPN.co.uk

Tottenham look further along than Man United, Barca’s Montjuic debut – ESPN.

Posted: Mon, 21 Aug 2023 17:22:00 GMT [source]

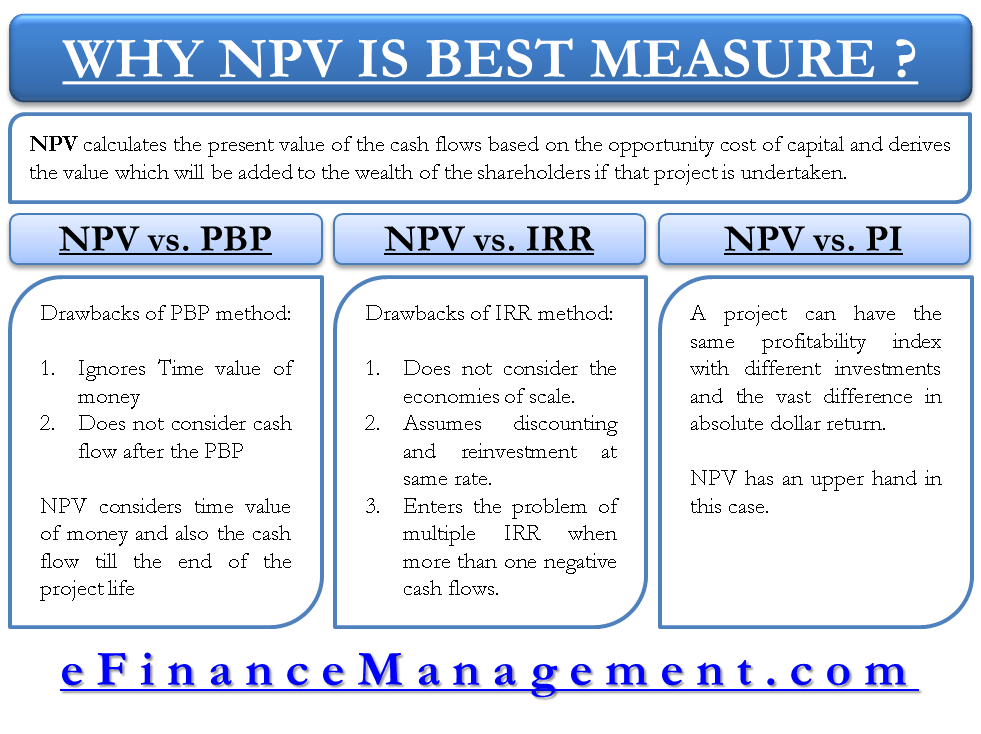

Some net payment arrangements offer early payment discounts as incentives. This can be expressed using a fraction which represents the percentage discount a customer receives for an early payment within a certain number of days. Settle is an effective go-between for payers and vendors that helps to ensure they hit their net terms. It’s a modern, reliable cash flow management system that ensures every invoice is paid by its deadline. Among businesses that allow customers to pay on credit, the most common net terms are net 30, net 60, and net 90.

Discounts Offered With Net Terms

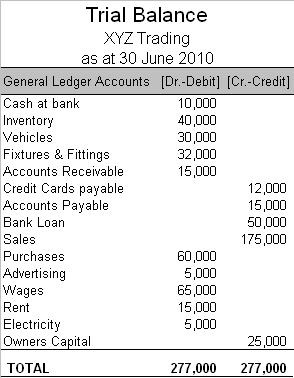

Whichever method you choose, make sure your customer is aware of it ahead of time so that both of you are on the same page. The terms gross and net are used frequently in accounting and finance conversations. The easiest way to know what someone means is to think about what could naturally be deducted from something. In finance and accounting, there are many items in the financial statements that are referred to as gross. Gross means the total or whole amount of something, whereas net means what remains from the whole after certain deductions are made. Adding a note on a line or two is all it takes to convert a standard invoice into one that offers net 30 terms.

You should be paid within the agreed-upon 30 days, although it’s worth remembering that late payments are an issue that many small-to-medium businesses (SMBs) deal with on a day-to-day basis. Alternatives could include paying on time or paying early to receive a discount However, for companies that truly need the net term to pay in full, these alternatives may not be satisfactory. One of the best alternatives to net terms is inventory financing or funding, which can be used by any product-based business (retail and wholesale). The key to inventory funding is to find a source that offers flexibility and affordability. You want to avoid driving costs up as a direct result of simply just trying to manage cash flow.

III. Cash invoice terms

A service called invoice factoring can put cash in your account right away; however, it won’t be for the full invoice amount. A new B2B e-commerce payment ecosystem requires the ability for buyers to get credit at the time of need, within the context of where they are making the online transaction. If that’s not available, and approval for net terms and trade credit is difficult, more abandoned carts are inevitable.

Of course, this also applies to other discounts, so a 2% discount on payments made within 10 days would read as ‘2/10 net 30’. Month end is a hectic time for most businesses, so EOM terms may not be as favorable, but they may be your only option. EOM terms allow customers to pay invoices within a specified number of days following month end. Accounting payment terms are the payment rules imposed by suppliers on their customers.

- It’s no secret that small business owners have to contend with hectic schedules.

- One way to help maintain steady cash flow is by offering net 30 terms.

- If you are in a competitive market, where you are one of many vendors, having short payment terms might disqualify you.

- The simplest way to define your payment policies is to make the process as convenient as possible for the customer.

- Those buyers must then often abide by non-negotiable payment terms.

This is another way in which net terms can compel a company to pay as soon as possible. You can make sure you get paid for work on Net terms by combining trade credit with accounts receivable automation. First, intelligent automation of trade credit lowers the credit risk you assume by extending credit. Accounts receivable automation then reduces costs and eliminates reliance on manual processes that are error-prone.

Normally, whenever a credit term (net 30) is extended, it is normal that the company will also offer a discount to motivate clients to pay earlier. People (companies included) are more willing to purchase goods or services if the payment for those purchases is delayed. This is perhaps why 20% of Americans use their credit cards for everything. With this short-term credit being extended to the client, you are providing an incentive for him to use your services or purchase your products. Businesses offer net 30 terms to their customers in their invoices in their due dates. If an invoice to a customer is dated March 15th and the payment due date is April 15th, then a business has offered that customer net 30 payment terms.